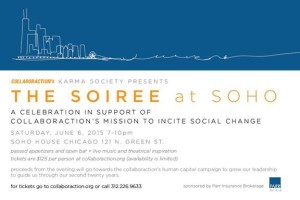

Chicagoland Cooperator’s Condo, HOA & Co-op Expo

The Chicagoland Cooperator’s Condo, HOA & Co-op seasonal Expo took place at the Navy Pier Convention Center, on Wednesday, November 18th from 10am-4:30pm. The Expo is for board members, property managers, condo, HOA and co-op decision makers. Dwight Zivo of Parr Insurance Brokerage was an insurance expert in one of the Advice Booths, a free advice panel available to attendees of the event.. The event was free.

The Chicagoland Expo is the largest expo in the state entirely dedicated to connecting condo, HOA, and co-op managers, board members, and residents with the professionals and service providers their communities need on a regular basis. Between nearly 300 exhibitors, countless product demos, free advice booths, and full roster of educational seminars, it’s literally a one-stop, custom-built marketplace for vendors, products and ideas.

“The express purpose of the Chicago Expo is to help attendees make useful, productive connections, gain valuable information, and network with their peers,” says company president Yale Robbins. So if you’re a decision-maker for a condo, homeowners association, or co-op community—or even if you just call one home—and you have a pressing legal issue or an important project waiting in the wings, you owe it to yourself and your community to drop by the Expo and experience what it has to offer. It would take months to meet with the same number of vendors and professionals a typical Expo attendee will interact with in one afternoon on the show floor.

A Learning Experience

One of the biggest reasons for board members, managers, and owners to visit the show is the Chicago Expo’s full slate of free educational seminars. Custom-built to help anyone involved—or even just interested—in the administration of a residential building or homeowners association, the 2015 seminar panels will provide in-depth discussion of the legal, administrative, management, and financial concerns pertinent to the region’s HOA managers, board members, and residents.

If you are interested in attending the expo as an audience member to enjoy one the free seminars, network with fellow individuals in your particular field of expertise or promoting yourself and business as an exhibitor next time around please visit http://fall.ilexpo.com/ to register!